To obtain VAT/BIN (Value Added Tax/Business Identification Number) registration in Bangladesh, you need to follow these steps:

- Collect Required Documents: To register for VAT/BIN in Bangladesh, you need to have the following documents:

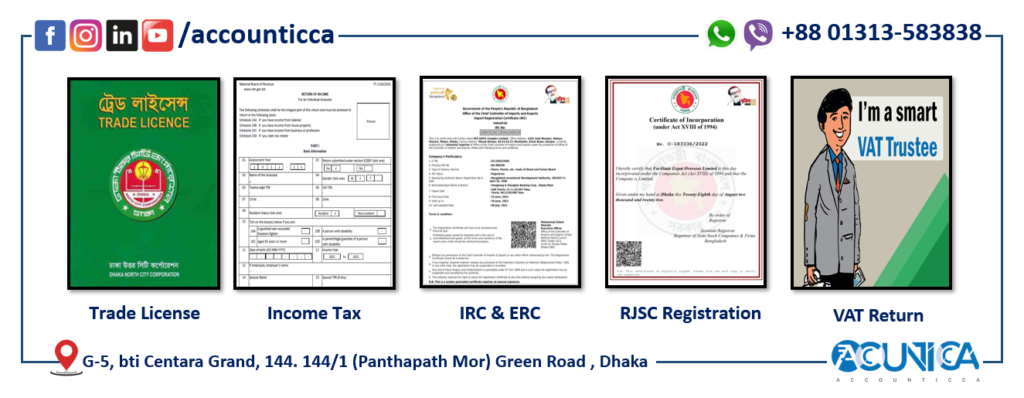

- Trade License

- TIN Certificate

- Bank Certificate

- Passport-size photograph of the owner or proprietor

- National ID Card of the owner or proprietor

- Rent agreement or utility bill for proof of address

- Fill out the VAT/BIN Registration Application Form: You can obtain the VAT/BIN registration application form from the VAT office or download it from the National Board of Revenue (NBR) website.

- Submit the Application: After filling out the application form, you need to submit it to the local VAT office along with the required documents mentioned above.

- Receive the VAT/BIN Certificate: Once your application is processed and approved, you will receive your VAT/BIN certificate.

- Display the VAT/BIN Certificate: You are required to display your VAT/BIN certificate at your business premises.

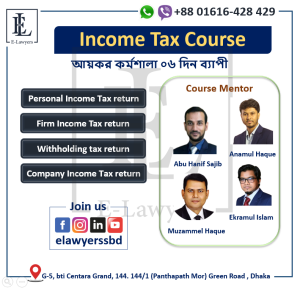

It is important to note that the VAT registration process in Bangladesh can be complex and time-consuming, and you may want to consider seeking professional help to ensure that your registration process is completed correctly.

@Accounticca is one of the leading professional service firms in Bangladesh and can assist clients to obtain VAT/BIN registrations. Contact Us