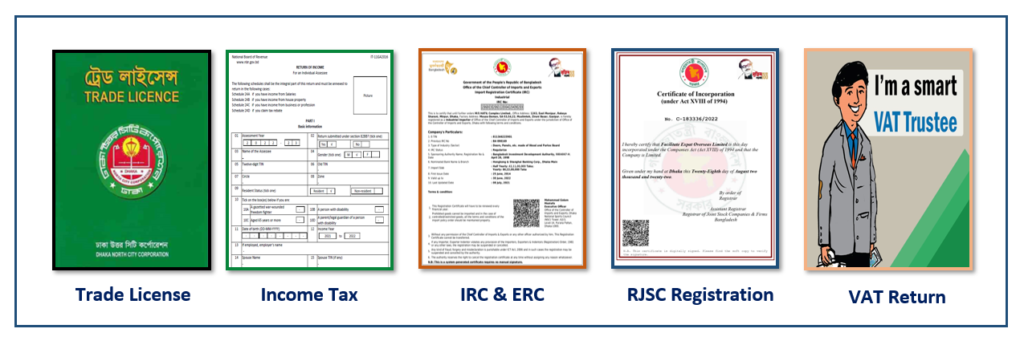

E-TIN registration, also known as Electronic Tax Identification Number registration, is the process of obtaining a unique identification number for tax purposes in Bangladesh. E-TIN is issued by the National Board of Revenue (NBR) and is required for various tax-related activities, such as filing income tax returns, paying taxes, and conducting business transactions

E-TIN registration in Bangladesh refers to the process of obtaining an Electronic Tax Identification Number (E-TIN) from the National Board of Revenue (NBR) in Bangladesh. E-TIN is a unique identification number assigned to individuals and entities for tax purposes in Bangladesh. It is required for various tax-related activities, such as filing income tax returns, paying taxes, and conducting business transactions.

- Visit the official website of the National Board of Revenue (NBR) at https://nbr.gov.bd/.

- Click on the “E-TIN Registration” or “Online E-TIN Registration” option, which is usually available on the website’s homepage.

- Fill out the online registration form with accurate information, including your name, date of birth, contact details, occupation, and source of income, among others. You may need to upload supporting documents, such as your national ID card, passport, or trade license, depending on the type of registration you are applying for.

- Review the information provided and submit the form.

- Upon successful submission, you will receive a Transaction Identification Number (TIN) or acknowledgment receipt.

- Print the acknowledgment receipt and sign it.

- Visit the nearest designated NBR office or tax circle office within 30 days with the signed acknowledgment receipt and original supporting documents for verification.

- After verification, you will receive your E-TIN certificate.

@Accounticca is one of the leading professional service firms in Bangladesh and can assist clients to obtain VAT/BIN registrations. Contact Us